GridGain powers instant, always-on payments

Deliver faster, more reliable, and more secure payment services with the GridGain unified real-time data platform.

Why the Payments industry needs modernization

Demand for faster payments is soaring from digital wallets to account-to-account (A2A) transfers and cross-border transactions. Financial institutions must deliver secure, scalable systems that handle massive transaction volumes with ultra-low latency without re-architecting core systems.

How GridGain solves the Payments industry challenges

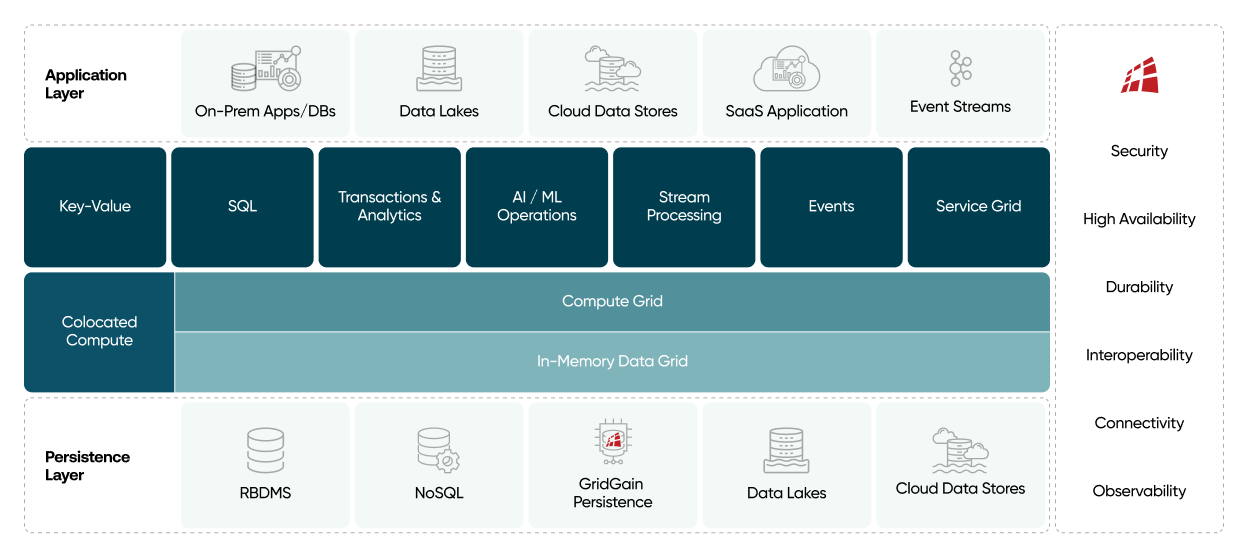

GridGain combines in-memory speed, persistent storage, and distributed compute in a unified real-time data platform.

The result: massive scalability, transaction consistency, high availability with near-zero RTO, and up to 10x faster performance.

Problems that the GridGain unified real-time data platform solves:

GridGain payment services use cases

Digital wallets and real-time payments (RTP) are now core to modern payments, but most banking and PSP architectures weren’t built for always-on, instant transactions.

GridGain: Enabling fast, always-on digital wallets

GridGain provides an ultra-low-latency data layer for digital wallets and RTP, offering in-memory processing for real-time checks (balance, risk, KYC/AML), horizontal scalability for peak bursts, and a distributed, fault-tolerant design and near-zero RTO for 24/7 uptime.

It delivers transactional consistency for instant ledger updates, enables unification of fragmented data for millisecond decisioning, and includes encryption/RBAC/audit trails to meet regulatory needs enabling responsive, scalable, always-available digital wallet experiences without re-architecting core systems.

Without a scalable, performant, and reliable data layer, A2A growth means higher risk, higher cost, and degraded customer experience.

GridGain: Powering real-time A2A at scale

GridGain enables banks and FinTechs to deliver instant, reliable A2A payment services with an architecturally superior data platform that unifies in-memory speed, persistent storage, and distributed compute in one integrated system.

In-memory processing provides real-time access for balance checks, fraud detection, and approvals, while being a horizontally scalable, fault-tolerant architecture and near-zero RTO, with transactional consistency, supporting millions of transfers with millisecond latency and no downtime.

Built-in encryption, RBAC, and ML-powered fraud detection meet compliance needs, and GridGain simplifies adding RTP, FedNow, and Open Banking services without requiring you to re-architect your core systems.

Read the blog post to learn more: Supporting Instant Account-to-Account Transfers at Scale

Cross-border payments are growing rapidly as businesses and consumers demand faster, cheaper, and more transparent international transfers.

Powering real-time cross-border payments

GridGain helps banks and PSPs deliver faster, more transparent cross-border payments with an architecturally superior data platform that provides in-memory speed, persistent storage, and distributed compute in one integrated system. Its unified real-time data platform gives instant access to payment, FX, and compliance data for routing, screening, and fraud detection at millisecond speed. The GridGain platform scales to handle millions of transactions while maintaining transactional consistency and predictable latency. A distributed, fault-tolerant architecture and near-zero RTO ensure 24×7 uptime, while built-in security and audit trails support compliance. With GridGain, institutions can cut processing costs, reduce exceptions, and add new corridors or ISO 20022 messaging capabilities without re-architecting their core systems.

Read the blog post to learn more: Supporting Cross-Border Payments at Scale

5 Customer success stories with GridGain

One of Europe’s largest banks modernized its payments infrastructure

A leading multinational bank relied on legacy caching technologies that struggled to scale and meet performance demands as transaction volumes grew. Hence, they decided to replace their fragmented legacy stack with a single, global real-time data platform capable of supporting multiple applications, including the SEPA instant payments gateway, which routes payments to and from the STET Payments Engine. They chose GridGain.The gateway now processes end-to-end payments in under 500 milliseconds— well below SEPA’s current 5-second regulatory requirement—while simplifying architecture, enabling horizontal scalability, and significantly reducing costs by decommissioning the legacy solutions.

A UK big-four bank accelerated cross-border payment processing

This leading financial institution was struggling to process cross-border payments quickly enough to meet SLAs. To reduce settlement times from days to hours, they needed to transition from the mainframe to a modern, scalable architecture. GridGain provided a unified API that bridged legacy and new systems, enabling multi-step migration for lagging applications. The result: dramatically improved performance, especially for batch reconciliation jobs, helping the bank meet SLAs and speed up payment processing.

Top 4 US bank modernized its FX settlement and collection system

A top global FX trading leader faced scalability and performance challenges with its decade-old Oracle DB–based monolithic FX Settlement & Collection system. Release cycles took months, restarts 40 minutes, and transaction processing ran overnight to minimize the impact on daytime performance. To modernize, they implemented a horizontally scalable GridGain-based data grid. GridGain’s distributed, in-memory solution enabled millisecond-level processing, reduced restart times from 40 minutes to 40 seconds, ensured 24×7 availability, and provided a foundation for faster feature delivery, meeting market demands and improving system reliability.

One of the largest U.S. card issuers modernized its merchant payment system

A multinational financial services company, with over 100 million cards worldwide, sought to modernize its merchant payment system to compete in a real-time economy. Legacy systems required days to settle payments, which delayed merchant payouts and impacted their cash flow. GridGain’s real-time in-memory data grid unified disparate systems, reduced processing times and infrastructure costs, and delivered a modern, scalable payment platform. Settlement times dropped from three days to three hours, improving merchant satisfaction and creating a foundation for ongoing innovation.

One of Europe’s largest banks offloaded its mainframe

A leading European bank faced capacity constraints and rising MIPS costs on its mainframe-based global direct debit system. Recovery Time Objectives (RTO) were long, and legacy technology limited future migration options. The bank implemented a GridGain-based cache with native persistence, replicating 25TB of data from the mainframe. This offload reduced the load on the mainframe, cut MIPS costs, dramatically lowered RTO, enabled easier access to skilled resources, and positioned the bank to decouple and migrate workloads when needed. Watch video

Achieve millisecond latencies at massive scale for your payments services.