GridGain Powers Instant, Always-On Payments

Modernize payment infrastructure for real-time rails with an ultra-low latency, ACID-compliant, horizontally scalable data platform built for 24/7 availability.

- Process end-to-end instant payments in under 500 milliseconds

- Cut settlement times from days to hours with real-time processing

- Achieve near-zero RTO using native persistence and fast restarts

- Run balance, risk, sanctions, and KYC/AML checks in real time

- Support SQL, key-value, streaming, and AI vector data together

- Meet PCI DSS, PSD2, Nacha, and ISO 20022 requirements

About this white paper

The payments industry is being reshaped by PayTechs, real-time rails, open banking, and digital wallets—driving pressure to replace legacy batch infrastructure with real-time, always-available systems. This white paper explains the modernization requirements and how banks, PSPs, FinTechs, and card networks can meet 24/7 availability, security, and compliance expectations while controlling costs.

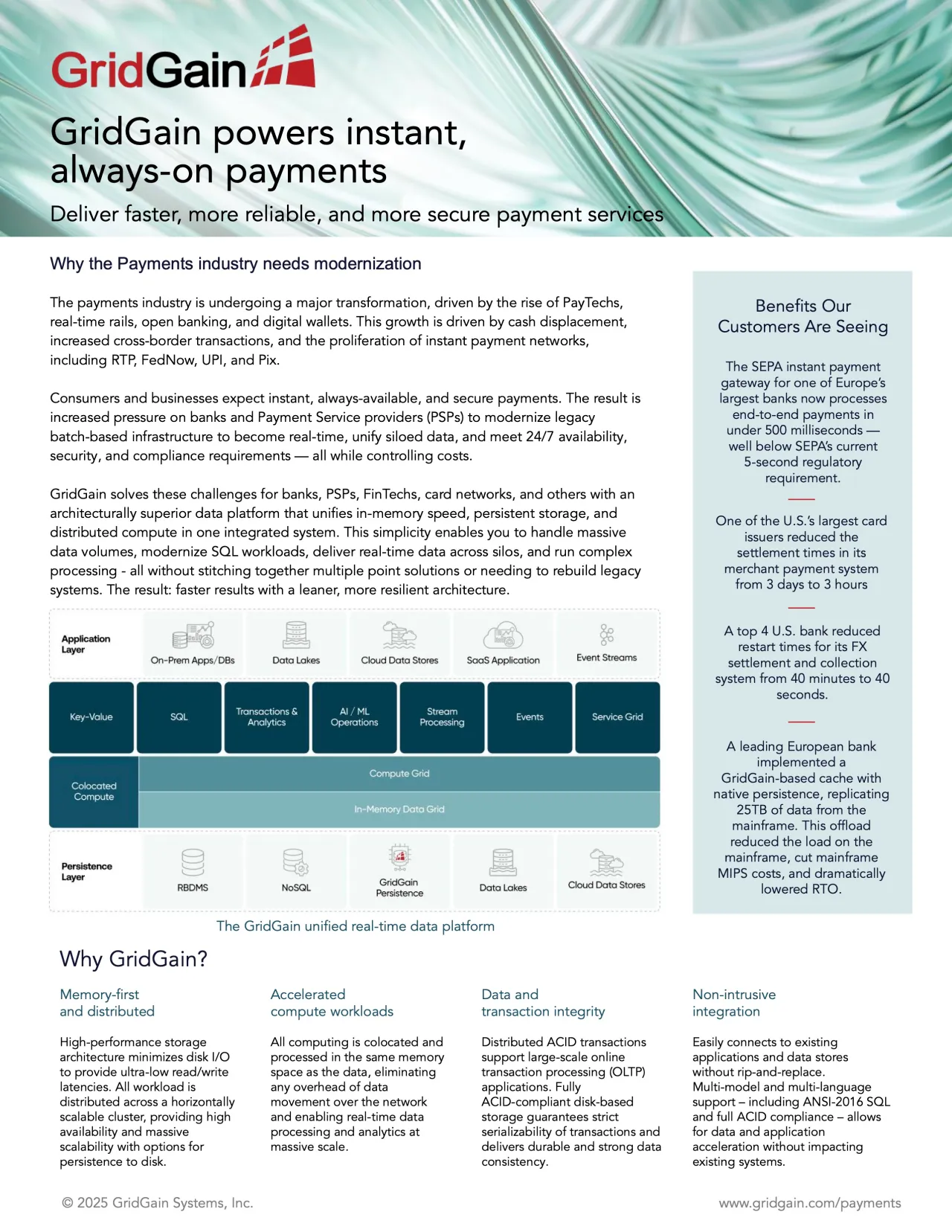

GridGain’s unified real-time data platform combines in-memory speed, persistent storage, and distributed compute in one integrated system, enabling massive scale, ultra-low latency processing, and non-intrusive integration with existing applications and data stores. It supports ANSI-2016 SQL, full ACID transactions, and disk-based durability, and can scale storage and compute independently.

The brief highlights outcomes customers are seeing—such as SEPA Instant processing under 500 ms, settlement-time reduction from 3 days to 3 hours, and restart-time reduction from 40 minutes to 40 seconds—plus key capabilities for A2A transfers, cross-border payments, RTP, and direct debits.

The SEPA instant payment gateway for one of Europe’s largest banks now processes end-to-end payments in under 500 milliseconds.

GridGain Powers Instant, Always-On Payments

Learn how GridGain powers instant, always-on payments with ultra-low latency processing, ACID transactions, real-time checks, and compliance for RTP, FedNow, SEPA Instant, UPI, and Pix.

Get the full white paper